Watch this "FULL VIDEO" to earn 3 crores with an investment of 25K in few years video:

Click here to watch FULL VIDEO

Click this Link to Visit our Youtube Videos on Stock Market

#adani #sharemarketindia #sharetrading #sharetradingtips #Banknifty #Nifty #sensex

As quoted by Albert Einstein “Compound interest is the eighth wonder of the world. He who understands it, earns it, he who doesn't, pays it.”

Before we understand power of compounding, let’s understand simple interest and compound interest.

Imagine you lend your friend money. The amount is Rs.10,000. the interest you charge him is 10% and the loan time period is 5 years. Every year you get Rs.1,000 as interest, a total of Rs.5,000 as interest over 5 years. This is simple interest.

Compounding in the World of finance refers to the ability of money to grow itself. It builds upon the fact that money can grow exponentially when you keep reinvesting your profits. Assuming the gains of year 1 get reinvested for year 2, gains of year 2 gets reinvested for year 3, gains of year 3 gets reinvested for year 4 and so on.

Simple interest is the interest that gets paid only on the outstanding principal. Compound interest is paid on both interest and the principal outstanding.

Assume that you invest Rs.100 which is expected to grow at 20% every year (also called as CAGR i.e., Compounded Annual Growth Rate). At the end of the first year, the money grows to Rs.120. Assuming that you do not withdraw the Rs.20 profit but rather invest it. This Rs.120 amount at the end of the 2nd year grows at 20% to Rs.144. At the end of 3rd year, Rs.144 grows at 20% to Rs.173. So on and so forth.

Now assume that you had withdrew this Rs.20 of profits every year. You would have collected Rs.60 of profits every year compared to Rs.73 in the compounded example where you didn’t withdraw any money. Now compare both, in just 3 years, there is a Rs.13 difference, which is almost a difference of 22% in terms of return!

Compounding is a powerful way to build wealth. It’s when the earnings from your investments get added to your original investment pile (reinvested) and those earnings then build upon themselves. Over time, these returns can compound on themselves, creating a snowball effect of growth.

Compounding is most commonly associated with long-term investing, such as investing in stocks, bonds or mutual funds. When investors reinvest their dividends or interest payments, they can take advantage of compounding to accelerate the growth of their investments. Compounding basically denotes how money makes money over a long period of time.

The power of compounding is perhaps best illustrated by the story of two friends A and B who started investing together in stocks but friend A stayed invested for 30 years and B stayed invested only for 20 years.

Assume A invests Rs.500 every month for 30 years and gets 14% return on his investments, his future value of investments will be Rs.27.8 lakh.

Assume B invests Rs.500 every month for 20 years and gets 14% return on his investments, his future value of investments will be just Rs.6.6 lakh.

Just see the difference of 10 Years. The amount that A gets by staying invested for 10 more years is 4.2x more than B!

To give an example, the stock of Titan went from Rs.0.15 to Rs.2,535, if held for last 20 years! Rs.1 lakh invested 20 years ago would now be Rs.169 Crore!

But this patience was rewarded only after going through turbulence in the stock price and periods of zero returns (time correction). Even when the price of Titan fell from Rs.1,600 in 2008 to Rs.600 in 2009, investors had faith in the stock.

But one must remember, these returns come with their own set of baggage. Time correction (periods of zero returns) do keep happening. The stock of Reliance industries didn’t give any returns from Dec 2007 to June 2017, but post that gave stellar returns. The stock of Hindustan Unilever, India’s largest FMCG company gave zero returns from March 2002 to April 2010. But post that it gave spectacular returns.

Moral of the story? If you are investing in a financial product for the long term, there will be periods of inactivity and drawdowns, but if you have done your research and if you have the conviction, you should stay put.

The longer you stay invested, the more money is made from your existing money which leads to the snowball effect. In the initial years, the size is small and the force is low but with time, the snowball size & force get bigger and bigger.

The best part is - Compounding is not limited to the world of finance. It can be applied to other areas of life, such as personal growth and skill development. When we learn new things, we can apply that knowledge to future learning, building on what we already know to deepen our understanding and accelerate our progress.

Compounding is a powerful tool for building wealth and achieving long-term success. By reinvesting earnings or returns, investors can take advantage of compounding to accelerate the growth of their investments. Whether applied to finance or personal growth, the concept of compounding underscores the importance of consistency, patience and a long-term perspective.

Start as early as possible. Save more, invest more and for longer. At the end of it, watch your money compound. The best way to take advantage of compounding is to start saving and investing wisely as early as possible. The earlier you start investing, the greater will be the power of compounding.

How to ensure that you reap the benefits of Compounding?

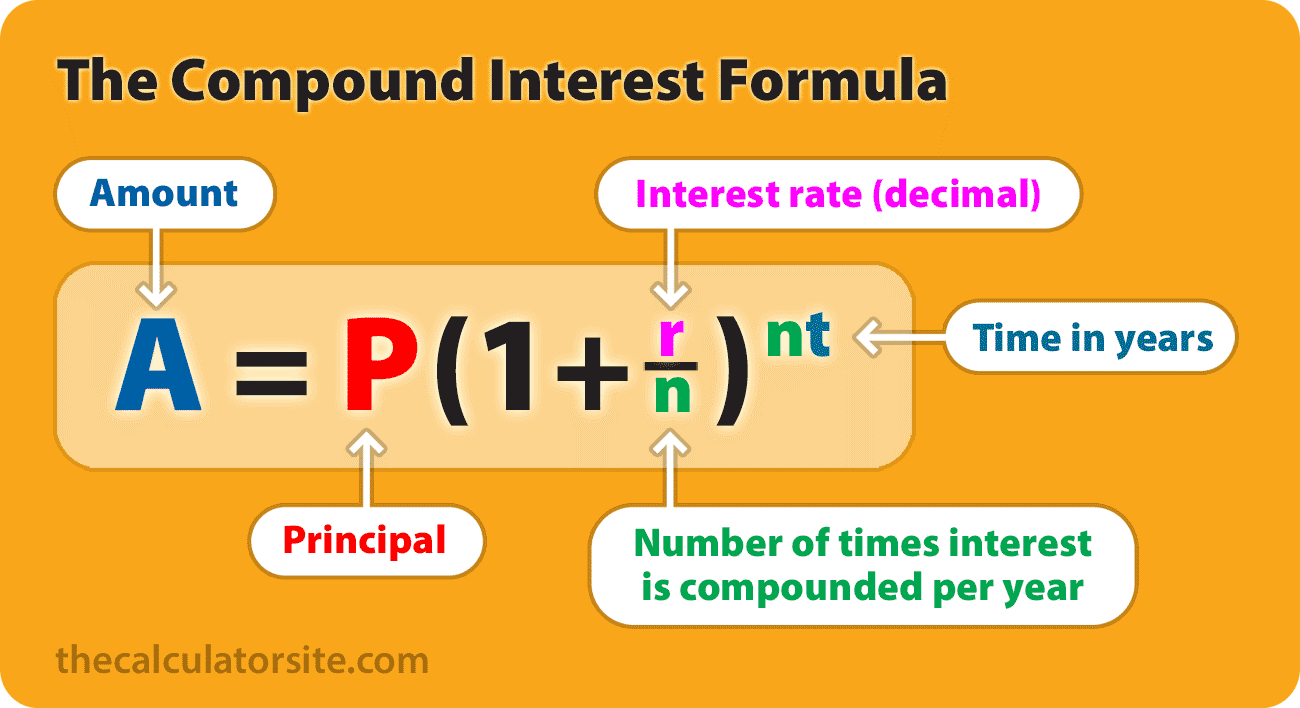

1. Start investing early The formula for Compound interest is – |

|

The whole world focuses on ‘R’, the rate of return that they can get. But what everyone misses is the ‘T’. The more you stay invested, the more your money earns money and then the kind of returns they earn is very big! The earlier you start investing, the more time your money has, to compound. Even small investments made early in life can grow into large sums over time, thanks to the power of compounding.

Take the case of Mr. Warren Buffet who was born in 1930. Investing at a young age, buying his first stock at age 11 and his first real estate investment at age 14. At Age 56, he was a billionaire. At Age 66 he was worth USD 17 billion, and today he is worth more than USD 106 billion! The best example of what happens when you stay invested. A significant proportion of his net worth increase happened in the past 12-15 years.

2. Invest regularly

An investor doesn’t need multimillion-dollar systems or technologies in place to make money, a simple monthly regular investment can do the trick. Investments that have been made consistently over time can help you benefit from compounding. You can consider setting up a systematic investment plan (SIP) that allows you to invest a fixed amount of money at regular intervals.

3. Choose the right investments

Now that investors know the ‘what’, choosing the ‘how’ is even more important. We all know how Equity creates wealth by giving more returns over a long period of time, when compared to other asset classes such as Bank deposits, Golds, Real Estate, etc.

One needs to invest in assets that have the potential to grow in such a way that it gives returns more than inflation, only then it becomes a value proposition.

One can explore Equity shares, mutual funds, among other options. However, remember that it’s imperative that you do your due diligence, find out your life/financial goals, risk appetite and see if those financial instruments will help you achieve your goals and see if the risks associated with the instruments lie within your tolerance level.

4. Patience

We have heard so many stories of legendary investors who made it big in the markets. They had a secret formula. It wasn’t their degree, it wasn’t luck, it wasn’t their brains but it was Patience.

One common thread between all the investors who made it big in the markets has been patience when it came to their investments. The power of compounding takes time to work its magic. It's important to be patient and stay invested for the long term, even if there are short-term fluctuations in the value of your investments.

In 2008 the net worth of Mr. Buffet declined from USD 62 billion to USD 37 billion. That is a 40% drawdown during the Great Financial crisis. But did that influence him to leave the markets? Not at all. Patience is the name of the game and even the best of the investors as we see here go through turbulent periods.

How do you make up for the bad periods? By being consistent with your investments!

Patience and Compounding is a marriage made in heaven. When these 2 combine, it leads to massive synergies!

5. Maintain the Discipline

Don’t break the cycle of compounding and just develop a habit of investing regularly.

There will be many periods of pessimism and turbulence in the markets but that shouldn’t stop you from investing.

Warren Buffett — 'We don't have to be smarter than the rest. We have to be more disciplined than the rest.'

6. Reinvest your earnings

‘Money makes money’, is a famous saying and this fact is nowhere as important as it is in the area of compounding. Reinvesting your profits ensures that the profit that you earn keeps getting bigger and bigger.

For example, if you own stocks that pay dividends, you can reinvest those dividends to buy more shares of the company.

To sum up, while you work for money, make sure you also make that money work for more money by investing it in assets that will appreciate at above inflation rate and also beats the returns of the traditional investment Assets. |

watch our youtube channel at:Click here to visit our Youtube channel:

If you have a working capital of around Rs 1 Lakh and willing to do selective positional trading,you can subscribe to bullsStreetCasino. Now the bullsStreetCasino tips are given through whatsapp.

Subscription details:

bullsStreetCasino positional stock option tips:Rs 1.65 Lakhs per year

or Rs 65555 per month.

Remit subscription to the following bank a/c:

Name of the current a/c:bullsStreet

Current a/c No:0500386000000076

Name of the bank:Lakshmi Vilas Bank Ltd

IFSC code:DBSS0IN0500

Remit by IMPS or NEFT from any bank a/c

or Remit thorugh GPay or PhonePe or PayTM or AmazonPay to:9843637728

After remitting subscription,send your name,place,Email ID along with payment details by whatsapp to:9843637728

Disclaimer apply.There is no guarantee.There is no warranty.There is no refund of subscription paid under any circumtances. All trading tips are given in 'bullsStreetCasino' online magazine are only for academic learning purpose only.

Watch this "FULL VIDEO" to earn 3 crores with an investment of 25K in few years video:

Click here to watch FULL VIDEO

ConversionConversion EmoticonEmoticon